CHARLESTON, W.Va. — West Virginia is one of seven states with a higher gasoline tax starting Saturday.

What’s actually going up in West Virginia is the floor on the varying tax on wholesale gasoline. The new floor is $3.04. So even though the average price at the pump is $2.26 a gallon right now in West Virginia, drivers will be taxed at the $3.04 price.

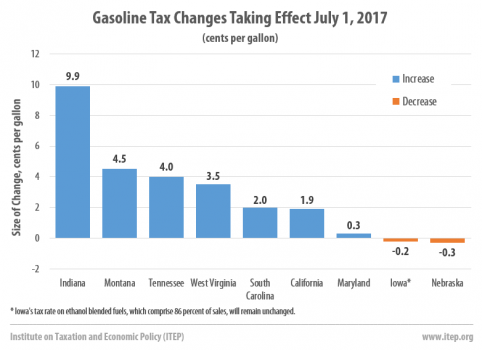

The upshot is an average tax increase of 3.5 cents a gallon.

More taxes and fees are going up this weekend as well, all an effort to raise more revenue for state infrastructure. A variety of fees at the Division of Motor Vehicles will increase and the privilege tax on vehicle purchases will rise from 5 percent to 6 percent.

MORE: West Virginians head to DMV before fees go up

The other states with gasoline taxes going into effect on July 1 include Indiana, Montana, Tennessee, South Carolina, California and Maryland. Gas taxes are actually being cut in Iowa and Nebraska.

West Virginia’s average price increase is about in the middle of all those states, according to the national Institute on Taxation and Economic Policy.

“This year we saw half a dozen states enact gas tax increases,” said Carl Davis, research director for ITEP.

“Tennessee was a state that had been debating it for a number of years. Same as South Carolina. There’s definitely a noticeable trend for higher gas taxes. There are a variety of reasons for that.”

In most states, including West Virginia, the cost of highway and bridge maintenance had begun to outpace the available funding.

Because part of West Virginia’s gas tax is tied to the average wholesale price of gasoline, state highways revenue went lower every time the price of gasoline went lower.

“With the price in West Virginia being tied to the price of gas we’ve seen tax cuts,” Davis said. “Asphalt, machinery and labor aren’t getting cheaper. There’s an inevitable imbalance there between the revenue coming in and the cost to maintain infrastructure.”

Nineteen states have waited longer than a decade to increase gasoline taxes, according to ITEP. Some of those, including Alaska, Louisiana and Oklahoma, seriously considered tax increases but chose not to do so yet.

“It’s not that the states that have waited decades have figured out some solution. Those states are facing shortfalls in their transportation infrastructure budgets,” Davis said.

“So they’re having to come up with the money somehow. But these states that have waited decades are facing real challenges in terms of their infrastructure.”

Because of the fluctuating tax on the average price of wholesale gasoline, West Virginia’s gas tax actually went down three straight years — including a drop of a penny this past Jan. 1, noted Mike Clowser, president of the Contractors Association of West Virginia.

Over that three-year span, Clowser said, West Virginia experienced a highways revenue drop of $50 million.

This change gets West Virginia even with where it was three years ago, Clowser said.

“It is not necessarily new money going into the highway department. That $50 million can go immediately into fixing roads, paving potholes and restoring bridges in the state,” Clowser said in a telephone interview today.

“We hope all parts of West Virginia will start to see an improved roads system after July 1. The DOH is going gangbusters to get these projects out on the street.”

Gasoline retailers wish there would never be a tax increase, but they understand the need for improved roads in West Virginia, said Traci Nelson, executive director of the West Virginia Oil Marketers and Grocers Association.

“We would rather the tax never go up, but we also need good roads to drive on,” Nelson said in a telephone interview.

The state portion of the gasoline tax will now be 35.7 cents. The full gasoline tax, including the federal portion, is 54.1 cents a gallon.

“It is always a concern on the borders where we’re not competitive,” Nelson said. “The tax in Virginia is 16.2 cents, so we’re already not competitive. The tax in Ohio is 28 cents.

“It’s a concern for our border retailers, sure. They’ve already been fighting this for a little while.”

But, she said, an increase of 3.5 cents is unlikely to change consumers’ behavior beyond what their habits are already.

“I don’t really think a 3.5 cent increase is going to change anyone’s behavior I really don’t,” Nelson said.

But heading into the Fourth of July holiday, some motorists might gas up today, getting a jump on the price increase coming Saturday.

“We are going into a holiday weekend,” Nelson said, “so there will be more people traveling and they might decide to fill up today and not do that tomorrow.”